Neobanks, the digital-first alternatives to traditional financial institutions, have revolutionized the way we think about banking. Operating exclusively online and eschewing physical branches, these digital banks or challenger banks prioritize mobile and online services, catering to a tech-savvy clientele. As the realm of neobanking swells, understanding their revenue generation mechanisms is vital for both consumers and industry insiders. So, let's learn, how do neobanks make money?

Contents

Through their digital-first approach, neobanks disrupt the conventional banking revenue model, typically characterized by high fees. Instead, they introduce a more transparent and competitive structure, often reducing or eliminating fees. Their revenue models are diverse, reflecting the varied needs of the markets they serve and offering multiple paths to profitability. Key models include:

Adapting and innovating within these models is essential for neobanks to stay competitive in a fast-evolving sector.

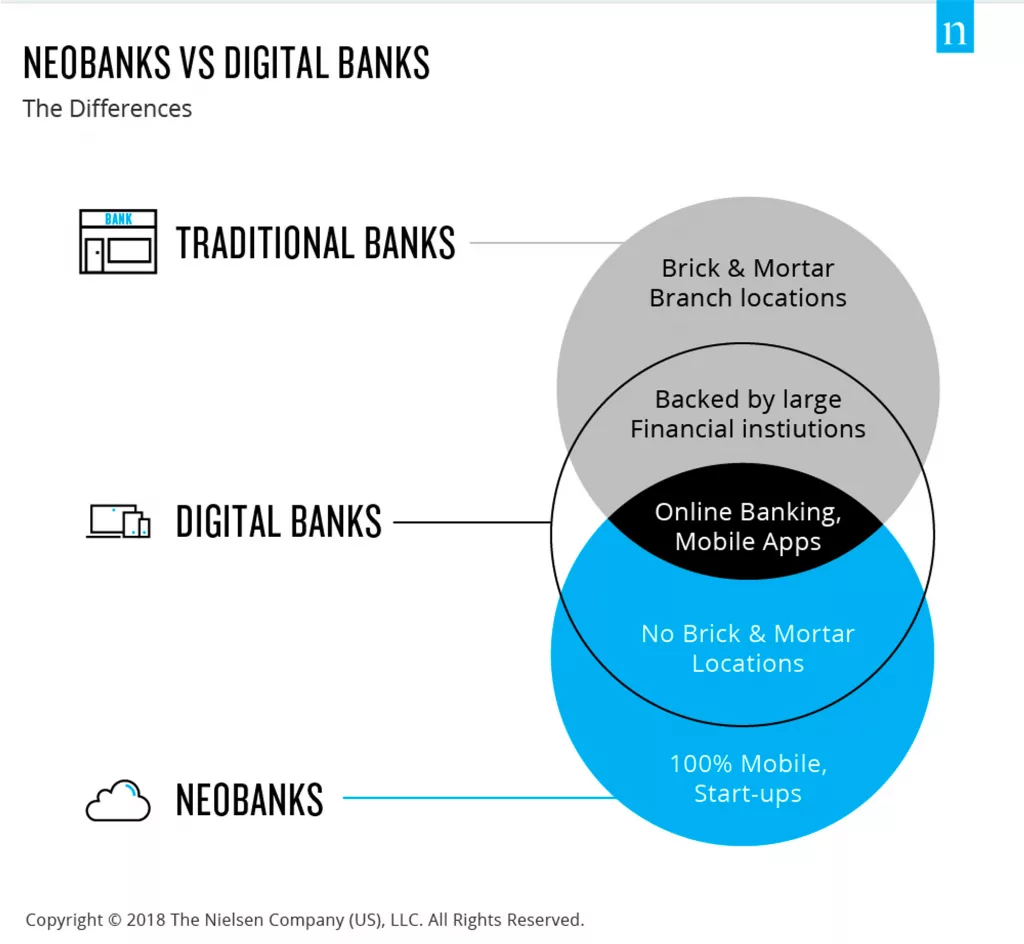

Neobanks set themselves apart from traditional banks by eschewing physical branches and the associated fees, focusing instead on user-friendly digital services. They exploit technological advancements and innovative business strategies to offer a range of competitive products and services. Revenue is generated through a mix of interchange fees, interest on deposits, premium services, and strategic partnerships.

Source: Nielsen (2019)

Interchange Fees: A significant portion of neobank revenue comes from fees charged to merchants for processing payments made with debit cards, a growing income source as digital payment adoption increases.

Interest Income: Offering higher interest rates on checking and savings accounts than traditional banks, neobanks attract deposits which they can then lend out, earning income on the interest rate differential.

Premium Services: Beyond basic banking, neobanks may offer advanced features for a fee, providing customers with enhanced banking experiences and additional services.

Partnerships and Referrals: By partnering with fintech companies and other service providers, neobanks can offer a broader range of services, earning fees through referrals and transactions.

Simplified, neobanks' revenue can be expressed as: Neobank Revenue=Interchange Fees+Interest on Deposits+Service FeesNeobank Revenue=Interchange Fees+Interest on Deposits+Service Fees

Here's a simplified formula outlining how neobanks make money:Neobank Revenue = Interchange Fees (from debit/credit card transactions) + Interest on Deposits + Credit Card Service Fees + ATM Fees Interest This formula summarizes the primary sources of revenue for neobanks, highlighting their reliance on interchange fees, interest income, and service fees to maintain profitability.

Advantages:

Disadvantages:

Analyzing the strengths of a neobank's business model involves:

By utilizing these analytical tools, experts can identify the key factors contributing to a neobank's success and competitive advantage in the market. Additionally, studying the scalability and adaptability of a neobank's business model can provide insights into its long-term viability and growth potential.

An agency specializing in fintech consultancy, like Markswebb, can analyze and enhance the revenue generation strategies of neobanks. With expertise in digital banking and financial technology, Markswebb offers tailored solutions to optimize neobank business models. Our services include comprehensive analysis of revenue streams, competitive benchmarking, and strategic recommendations for improving profitability. Additionally, we provide insights into customer behavior, market trends, and regulatory compliance to ensure sustainable growth for neobanks. By leveraging our expertise and industry knowledge, neobanks can enhance their revenue generation capabilities and stay ahead in the competitive fintech landscape.

Explore our European best mobile banking app review 2023.

Connect with us today to transform your digital experience.

Grasping how neobanks generate revenue is pivotal for individuals contemplating a shift towards digital banking solutions as well as professionals navigating the fintech ecosystem. Neobanks are at the forefront of banking innovation, offering digital, customer-focused solutions that challenge traditional banking paradigms. By understanding and leveraging their unique business models, neobanks continue to carve out significant niches in the financial services industry, reshaping expectations and experiences of banking in the digital age.

Our collection of articles, FAQs, and glossaries offers clear, concise explanations of widely used terms and concepts. Beyond definitions, the Handbook MW is a portal to understanding how these terms apply in real-world scenarios.

From research and analysis to strategy and design, we help our clients successfully reach their customers through digital services.

We respond to all messages as soon as possible.