The development of mobile banking in Kazakhstan reflects broader trends in the global fintech landscape. With a history of observing and analyzing fintech services, Markswebb has conducted extensive research to identify key trends and practices shaping the market - take a closer look at Mobile Banking Rank Kazakhstan 2024. The main point to consider is that we have identified a critical tension in the market, which will be resolved through intense competition for leadership in mobile banking. To find out exactly how to gain audience loyalty, read our insights.

Contents

The fintech market in Kazakhstan is experiencing significant growth, driven by increased adoption of digital financial services and a rise in mobile banking usage. However, the market is becoming increasingly competitive, with a strong focus on enhancing the quality of the client experience to gain a competitive edge.

An important aspect to consider is that the foundation of these insights is based on public information from the National Bank, rather than our own project data. This context plays a vital role in the development of mobile banks. With an understanding of these external factors, we are well-positioned to assist in cultivating a leading service.

Kazakhstan has seen a significant rise in the issuance of bank cards over recent years. This increase highlights the growing adoption of digital financial services. The number of bank cards in circulation has steadily climbed, indicating a robust demand for digital payment solutions.

Alongside the growth in card issuance, there has been a notable uptick in card usage. The number of payment transactions per card and the volume of transactions have both seen substantial increases. This trend suggests that consumers are increasingly relying on digital banking solutions for their daily financial activities.

The user base for digital banking services in Kazakhstan has expanded, though the growth rate has shown signs of plateauing. This trend highlights a maturing market where digital banking adoption is becoming more widespread, but the pace of new user acquisition is stabilizing.

Although there is growth in the digital banking user base, the rate has shown signs of plateauing.

The key insight reveals that banks in Kazakhstan are currently facing challenges in differentiating their digital services, as most mobile banking applications offer similar functionalities and experiences. The bank that acknowledges this gap and takes proactive steps to enhance the quality of its digital services will not only secure customer loyalty but also achieve significant financial gains. By focusing on superior user experience and innovative solutions, a bank can distinguish itself in a competitive market and become a leader in the fintech sector.

Based on the research data and the diverse experiences we have studied from various countries, it is clear that the key driver of growth lies in the quality of the client experience.

Quality of customer experience in the app is a key factor of the business model in fintech and the #1 metric for businesses.

Here is our key insight: in the current competitive landscape among Kazakh banks, you don't need to be perfect for your clients; you just need to be slightly better than your competitor. This small advantage will be enough to attract customers to your services. So take a breath. Catch the favorable moment. A little bit of effort will yield a lot of results.

And we are always here to help you – with the power of our accumulated knowledge at your disposal. Knowledge is power, isn't it? Make the most of ours!

We have just released a comprehensive study: Mobile Banking Rank Kazakhstan 2024. This research thoroughly examines the digital financial services market among mobile banks in Kazakhstan, evaluating over 700 criteria focused on user experience for private customers.

The analysis identifies key growth opportunities and offers practical recommendations for financial institutions to enhance their digital offerings. The Markswebb team provides strategic collaboration and deep industry insights, customizable to specific business needs.

You can access the public results of the research and order the full report, an audit, or consulting services based on our evaluation system. Just contact us!

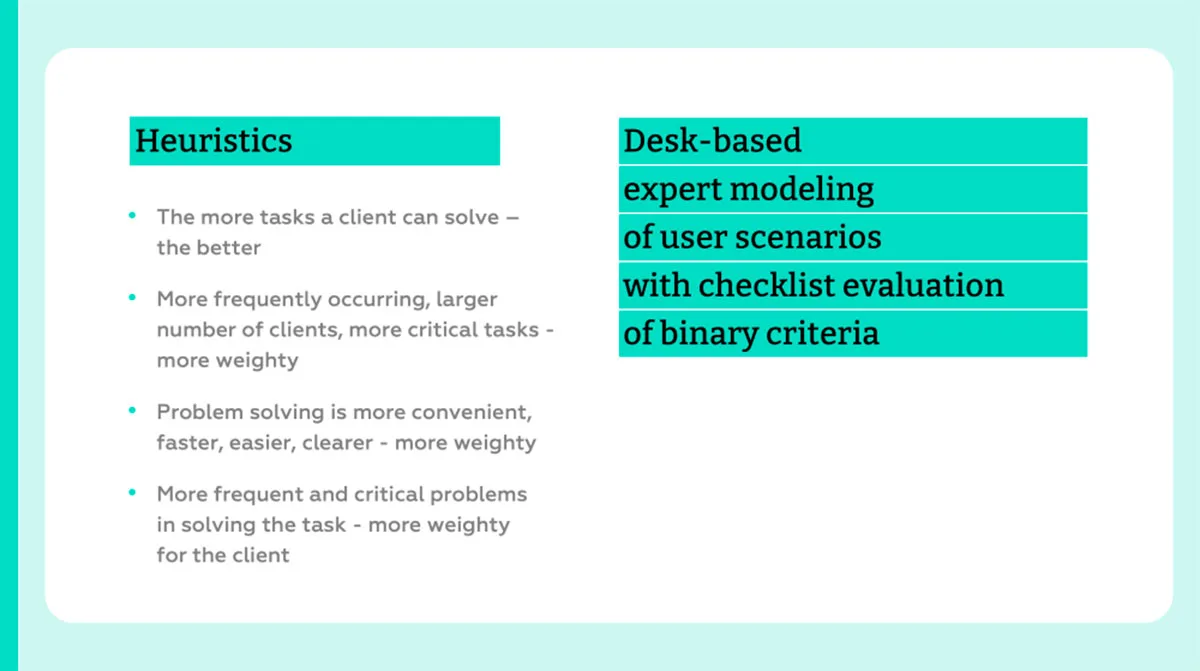

Our evaluation system for mobile banking applications measures how effectively clients can complete various tasks. The system assigns more weight to frequently occurring and critical tasks, providing a comprehensive assessment of the application’s usability. This approach helps identify best practices and areas for improvement.

The evaluation system is tailored to the specific needs and characteristics of the Kazakh market. By comparing and rating leading banking and payment applications locally, Markswebb provides actionable insights that help banks enhance their digital offerings.

Drawing from a global base of fintech practices, Markswebb’s research includes a compilation of best practices in mobile banking. This compilation serves as a benchmark for Kazakh banks, offering insights into successful strategies implemented worldwide.

Good news! We have a unique database of top European fintech practices. The Banking Growth Features Navigator and the Best Mobile Banking Apps Database, developed by Markswebb, are excellent tools for businesses looking to enhance their digital offerings and gain a competitive edge. These resources offer comprehensive insights into successful strategies and innovative solutions used by leading mobile banking applications in Europe.

If you require a specific set of solutions tailored to your business needs or custom data collection for your digital service, the Markswebb Scout team is available to help. Additionally, the Global UI Search service provides access to digital services worldwide, allowing you to benchmark and adopt best practices from global leaders.

For more information on how our Navigator and Database can support your business, or to explore the Global UI Search service in detail, please contact us. Our team is ready to offer tailored support and insights that align with your specific needs and objectives.

The results of our research will help accelerate development and improve the quality of client experience in mobile banking in Kazakhstan. Markswebb's expertise and achievements in the Kazakh fintech sector are extensive. We identify the leaders in mobile banking and highlight the best practices to follow. Want to know quickly and accurately which user tasks are most promising for increasing transaction activity? We'll give you a hint. And we'll also point out the tasks that will increase user reach and frequency. Let's work together!

We respond to all messages as soon as possible.

We’ve evolved dozens of successful financial services and are eager to prove that our expertise can be implemented in other industries and around the world. Have a look at our success stories!