The mobile banking sector in Azerbaijan is experiencing a pivotal transformation, underpinned by a surge in the issuance of bank cards and a notable increase in card usage, as our recent data highlights (please, read more information in our Mobile Banking Rank Azerbaijan 2024). This change is not just a reflection of growing financial inclusion but is also indicative of a deeper, technology-driven shift in consumer behavior. Let's look at the top 3 expert insights for Azerbaijan's fintech sector.

Contents

Azerbaijan's fintech sector is experiencing rapid growth driven by a strong push for digital transformation across the financial services industry. This growth is fueled by governmental support through initiatives aimed at enhancing the digital infrastructure and regulatory framework to foster fintech development. The country has seen significant increases in the use of digital payment systems, with transaction volumes growing by over 40% annually since 2018.

Thus, we are witnessing a substantial and consistent growth trajectory in Azerbaijan's fintech sector. Now, let's delve into the numbers to see what they reveal.

At Markswebb, we have been monitoring and analyzing digital banking services for over 12 years, witnessing their evolution firsthand. For the latest phase of our research, using data from the National Bank of Azerbaijan, the following key points can be highlighted:

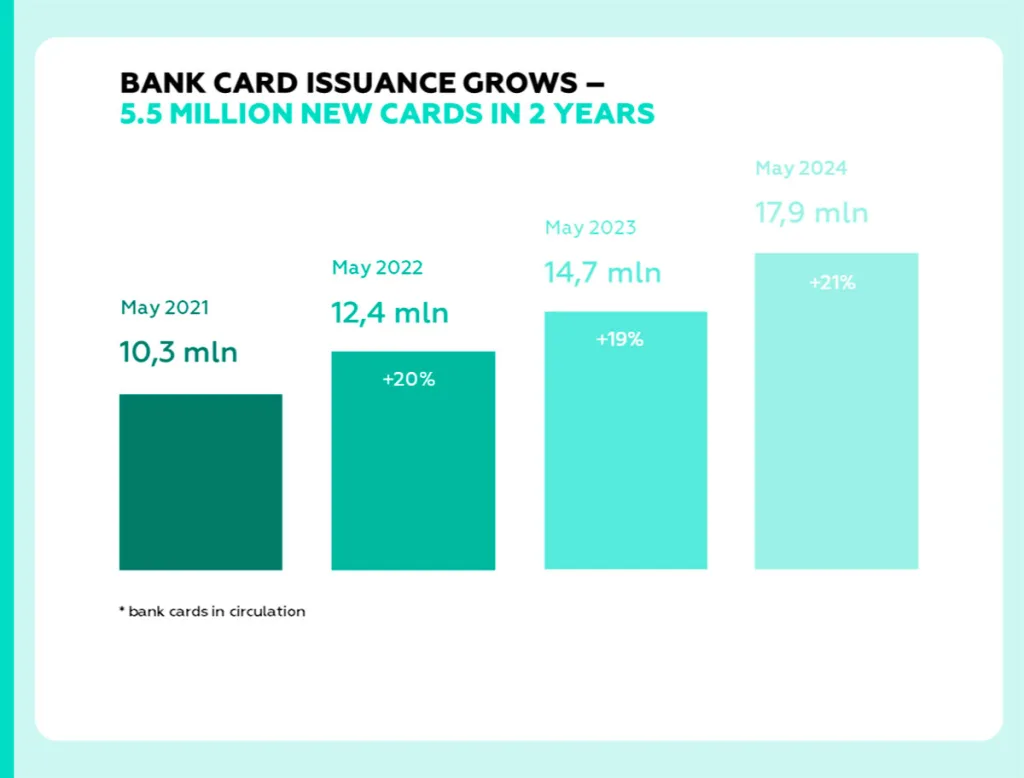

From May 2021 to May 2024, the number of bank cards in circulation is projected to increase from 10.3 million to 17.9 million, representing a robust growth rate of over 70%. This escalation is not merely numerical but signifies a broader acceptance of digital financial tools by the Azerbaijani public.

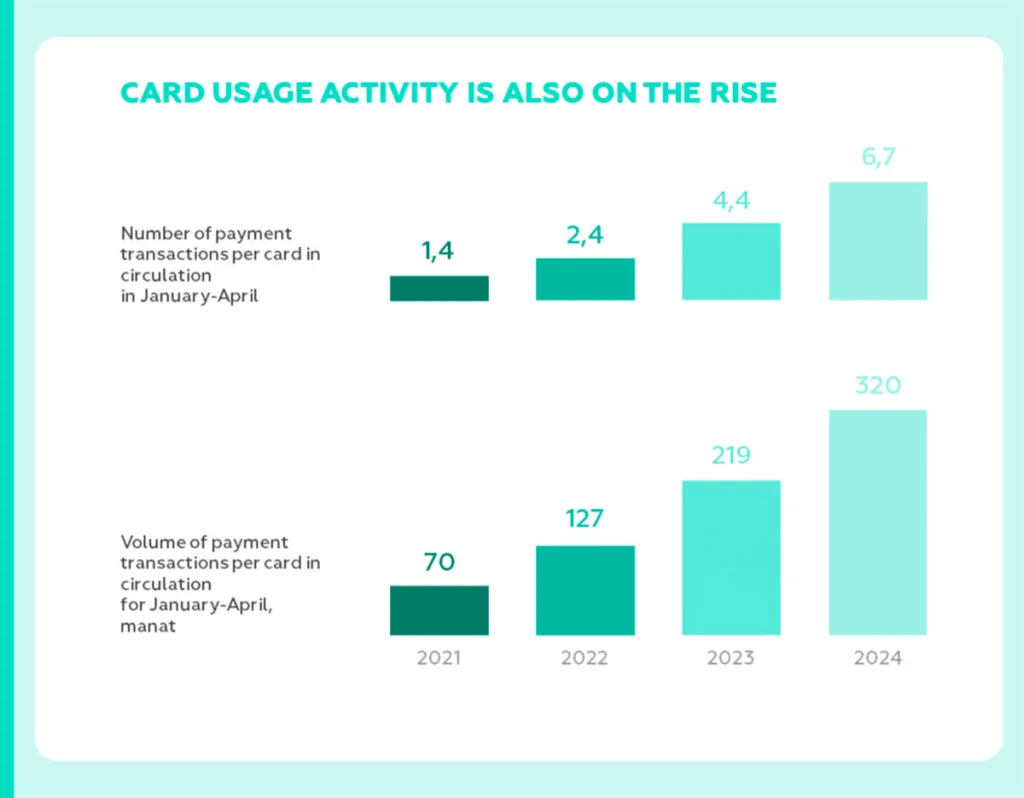

Parallel to the increase in card issuance, there is a significant uptick in card utilization. By 2024, the average number of transactions per card is expected to grow exponentially from 1.4 to 6.7 transactions, accompanied by a surge in transaction volume from 70 to 320 manat. These figures are a testament to the increasing reliance on digital banking solutions, reflecting a shift towards a more digitally-oriented consumer base.

The digital banking landscape is increasingly competitive, with institutions striving to offer superior client experiences. The growth in mobile app installations among leading banks from 2022 to 2024 demonstrates a strategic focus on enhancing mobile banking services to capture and retain users. For instance, Kapital Bank is anticipated to see a staggering increase in app installations, indicating a successful alignment with consumer expectations and digital trends.

In our research, we have uncovered numerous growth opportunities for banking services in Azerbaijan. By applying our proprietary approach and leveraging a constantly updated database of best practices from leading fintech markets worldwide, we identify key areas for improvement. Here are three examples of our methodology in action:

Simplifying the customer journey is essential for enhancing user experience and increasing engagement. By reducing the steps needed to complete transactions, banks can significantly improve customer satisfaction and loyalty.

Enhancing online ordering capabilities can drive higher conversion rates and better customer retention. Providing clear, accessible information and tools for users to make informed decisions is crucial.

Effective customer support mechanisms are vital for maintaining high levels of customer satisfaction and trust. Automated and easily accessible support can greatly enhance the overall user experience.

You can get the full range of discovered practices and insights in the complete report – request it now.

Wondering how to create seamless digital banking experiences? Explore Markswebb’s handpicked UI solutions for 2024, grounded in our Mobile Banking Rank research. Get inspired and start building better services today!

To navigate this competitive landscape effectively, Markswebb introduces a robust framework for assessing the quality of digital client experiences. This system emphasizes the importance of resolving user tasks efficiently and highlights the frequency and criticality of these tasks as key metrics.

Here is the essence of our heuristic approach:

The approach is geared towards identifying areas where banks can significantly enhance their service offerings to improve customer satisfaction and loyalty.

Our data opens a window of opportunity that would be ridiculous not to capitalize on. The current trajectory of the mobile banking sector in Azerbaijan offers significant opportunities for growth and innovation. For more detailed information and strategic guidance, financial institutions can utilize Markswebb's research and advisory services. This is the easiest, most cost-effective and professional way to effectively navigate the changing digital landscape.

So we're waiting for you - let's get to work!

We respond to all messages as soon as possible.

We’ve evolved dozens of successful financial services and are eager to prove that our expertise can be implemented in other industries and around the world. Have a look at our success stories!