The UAE has always been at the forefront of technological adoption. Its vision to reduce economic oil dependency has birthed several initiatives aimed at fostering innovation. Among these, the "UAE blockchain strategy" stands out, with its bold aim to make the UAE a world leader in blockchain technology. This strategic move is not just about adopting new technology but creating a holistic digital ecosystem that can cater to the needs of its large expatriate population, who are accustomed to the digital-first approach of their home countries.

Contents

The first notable instance of blockchain technology being adopted for digital banking in the UAE can be traced back to around 2016. During this period, various entities within the UAE began to explore and integrate blockchain technology to enhance the efficiency, security, and reliability of their banking operations.

As of 2024, blockchain technology in banking has continued to grow significantly, both in terms of adoption and the scope of applications. The technology has permeated various aspects of banking, including payments, clearance and settlement systems, fraud reduction, KYC (Know Your Customer) processes, and even in the issuance of digital currencies by central banks (known as CBDCs, or central bank digital currencies).

Dubai's largest bank Emirates NBD is the first to successfully implement blockchain technology to combat fraudulent transactions

In the UAE, two major blockchain initiatives have captured the public's interest.

The UAE Trade Connect (UTC) is a collaborative initiative that links several major UAE banks onto a single platform powered by blockchain technology. This venture is primarily aimed at combating fraud in invoice financing—a sector prone to high levels of financial discrepancies due to the complexity of transactions and the involvement of multiple parties. Invoice financing, where businesses borrow money against the amounts due from customers, often becomes a fertile ground for fraudsters to duplicate invoices or inflate amounts.

By implementing blockchain technology, UTC brings a revolutionary approach to tackling these issues. Blockchain's inherent qualities—transparency, immutability, and security—ensure that once transaction data is recorded, it cannot be altered without consensus from all parties involved. As a result, UTC has effectively safeguarded millions of dollars annually, which might otherwise be lost to fraud. This not only protects the financial institutions involved but also secures the economic ecosystem at large, reinforcing the UAE’s position as a safe and reliable business hub.

The second major initiative, the KYC (Know Your Customer) blockchain platform, represents a leap forward in customer verification processes—a critical aspect of modern banking. KYC processes are vital for preventing identity theft, financial fraud, money laundering, and terrorist financing. Traditionally, these processes have been cumbersome, slow, and prone to errors, often requiring repetitive submission of documents by customers when interacting with different financial institutions.

The KYC blockchain platform addresses these challenges by creating a unified, secure digital registry for customer data. On this blockchain platform, customer verification data is stored securely and can be accessed by any participating financial institution. This not only speeds up the verification process, making customer onboarding faster and more efficient, but it also reduces operational costs associated with the manual handling of KYC procedures.

The KYC Blockchain Platform also promotes greater integration within the banking sector. By providing a shared and immutable record of KYC data, it allows banks to offer a more seamless service to their customers. For instance, once a customer is verified on the blockchain platform, they do not need to undergo the same process again with another bank in the network. This interconnectedness not only enhances customer satisfaction but also drives efficiency, as banks can leverage the shared data to offer more tailored and swift financial services.

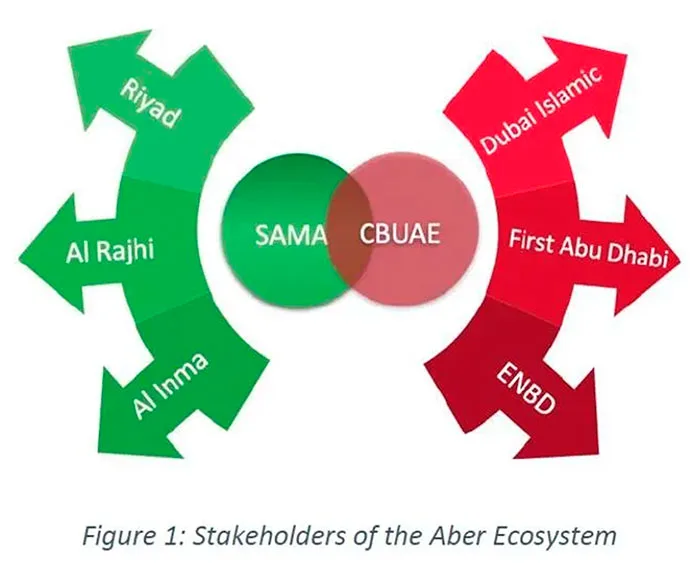

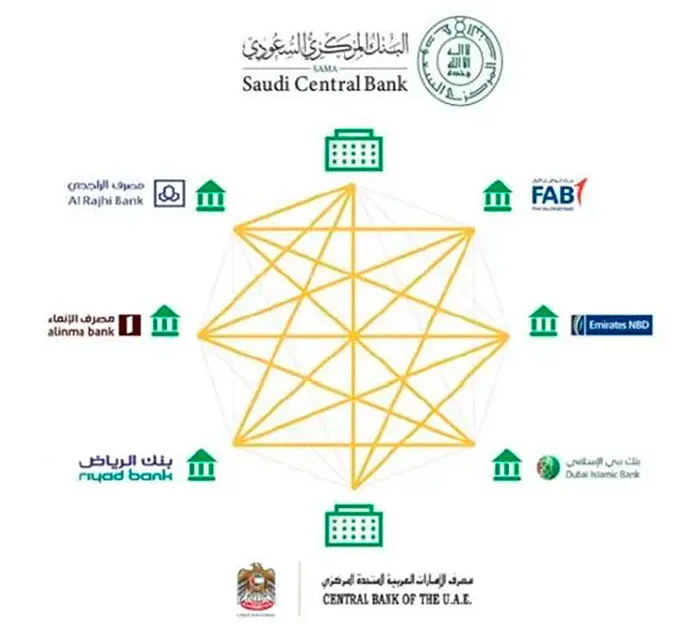

Launched by the Saudi Central Bank and the UAE Central Bank, Project Aber was a groundbreaking initiative exploring the use of a jointly issued digital currency for cross-border payments. This project demonstrated the potential of distributed ledger technology (DLT) to revolutionize traditional banking by enhancing the efficiency, security, and resilience of payment systems.

Project Aber successfully confirmed the technical viability of using blockchain for secure and efficient cross-border transactions. Key outcomes included the development of a dual-issued digital currency that facilitated real-time settlements between commercial banks in Saudi Arabia and the UAE. This initiative showcased significant improvements in transaction speed and reductions in the complexities associated with conventional banking systems.

The successful implementation of Project Aber has laid a robust foundation for future advancements in digital banking within the GCC. The insights gained from this project are expected to guide further innovations in blockchain applications, potentially transforming the financial landscape by providing a blueprint for similar initiatives globally.

The real-life impact? A customer in Dubai can effortlessly execute a secure transaction with a vendor in Riyadh within minutes, not days.

Stakeholders of Aber ecosystem, from Aber Report

Widest network in Aber, from Aber Report

One of the most significant advantages of blockchain in the UAE’s banking sector is its ability to tailor services for the expatriate majority. Blockchain technology facilitates a range of financial services from remittances to international investments, all while ensuring security and compliance. For expatriates, this means a banking experience that’s not only familiar but also deeply integrated with their needs, providing a sense of security and belonging far from home.

Markswebb is analyzing the UAE fintech market for the expats with the "Mobile Banking Review UAE 2024" study. It evaluates leading banks using over a thousand criteria to identify best practices and growth opportunities in the Emirates' dynamic banking sector.

Despite the optimism surrounding blockchain, the journey is not without its challenges. Regulatory hurdles, the need for extensive infrastructure, and the slow pace of technology adoption among traditional banks pose significant barriers. However, with ongoing governmental support and collaboration between financial entities, these challenges are gradually being overcome.

Looking ahead, the future of blockchain in UAE’s banking sector appears bright, with potential applications ranging from enhanced cybersecurity measures to smart contracts that automatically execute transactions under specified conditions. The possibilities are limitless, and as blockchain technology matures, its integration into mainstream banking will only deepen, driving more innovative solutions in the financial landscape.

Markswebb, as an analytical agency specializing in user research, interface audits, and the collection of best practices, is exceptionally well-equipped to refine digital banking services through blockchain technology. By applying its expertise in benchmarking and understanding user needs, Markswebb can guide banks in integrating blockchain to enhance user interfaces and customer experiences.

We respond to all messages as soon as possible.

We’ve evolved dozens of successful financial services and are eager to prove that our expertise can be implemented in other industries and around the world. Have a look at our success stories!