Uzbekistan's fintech sector is witnessing rapid growth, particularly in mobile banking. This expansion is driven by an increase in banking card issuance and a shift towards cashless transactions. According to the international consulting agency Markswebb, to sustain this momentum and ensure the long-term success of mobile banking services, it is crucial for Uzbekistan to adopt a global perspective and integrate best practices from international markets.

Contents

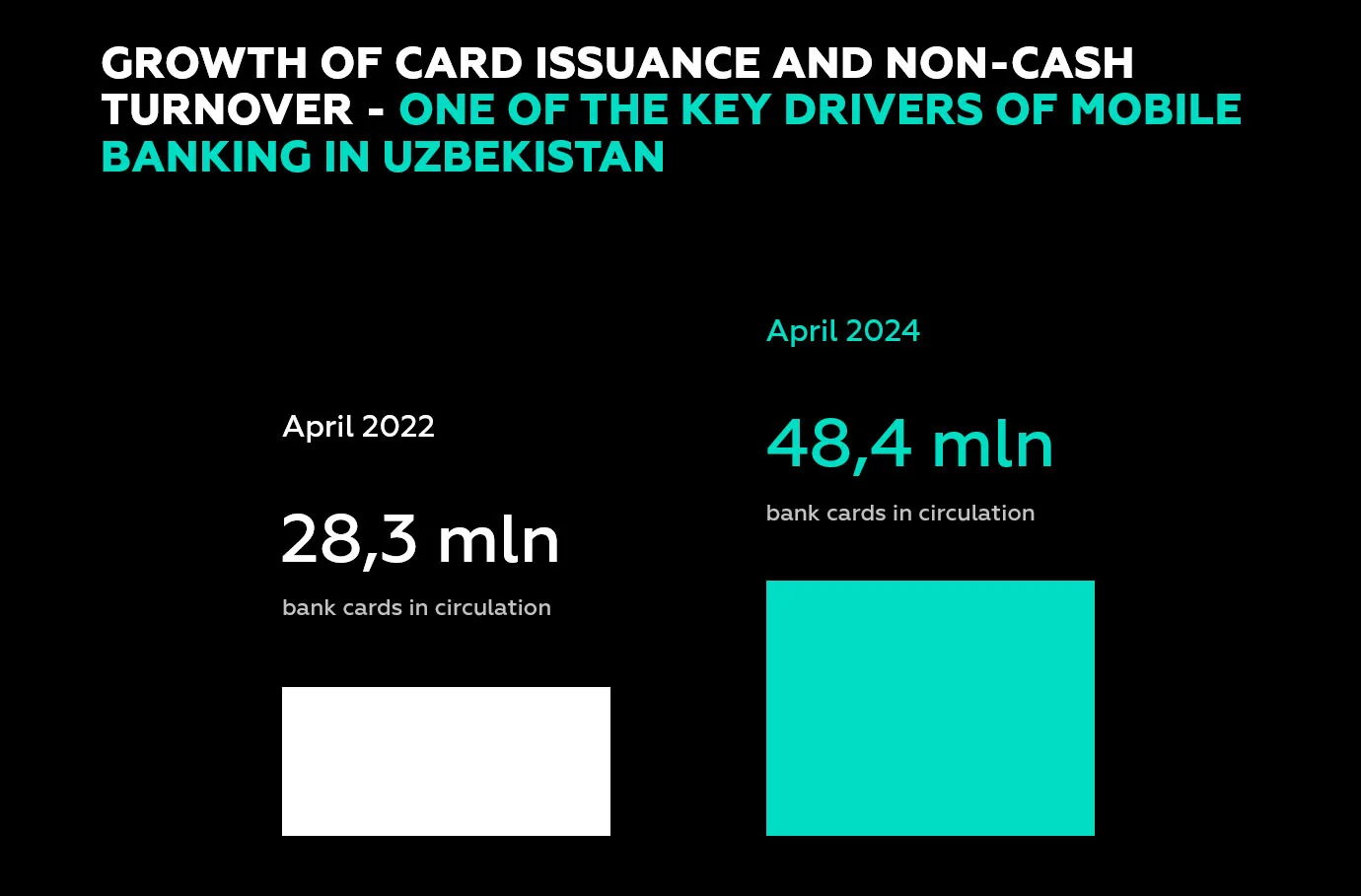

The number of banking cards in circulation in Uzbekistan has surged significantly: from 28.3 million cards in April 2022, the figure rose to 48.4 million by April 2024.

This growth in card issuance is a primary driver for the adoption of mobile banking services. As more consumers gain access to banking cards, the demand for mobile banking applications to manage these accounts increases correspondingly. Additionally, the broader push towards cashless transactions further fuels the need for efficient and user-friendly mobile banking solutions.

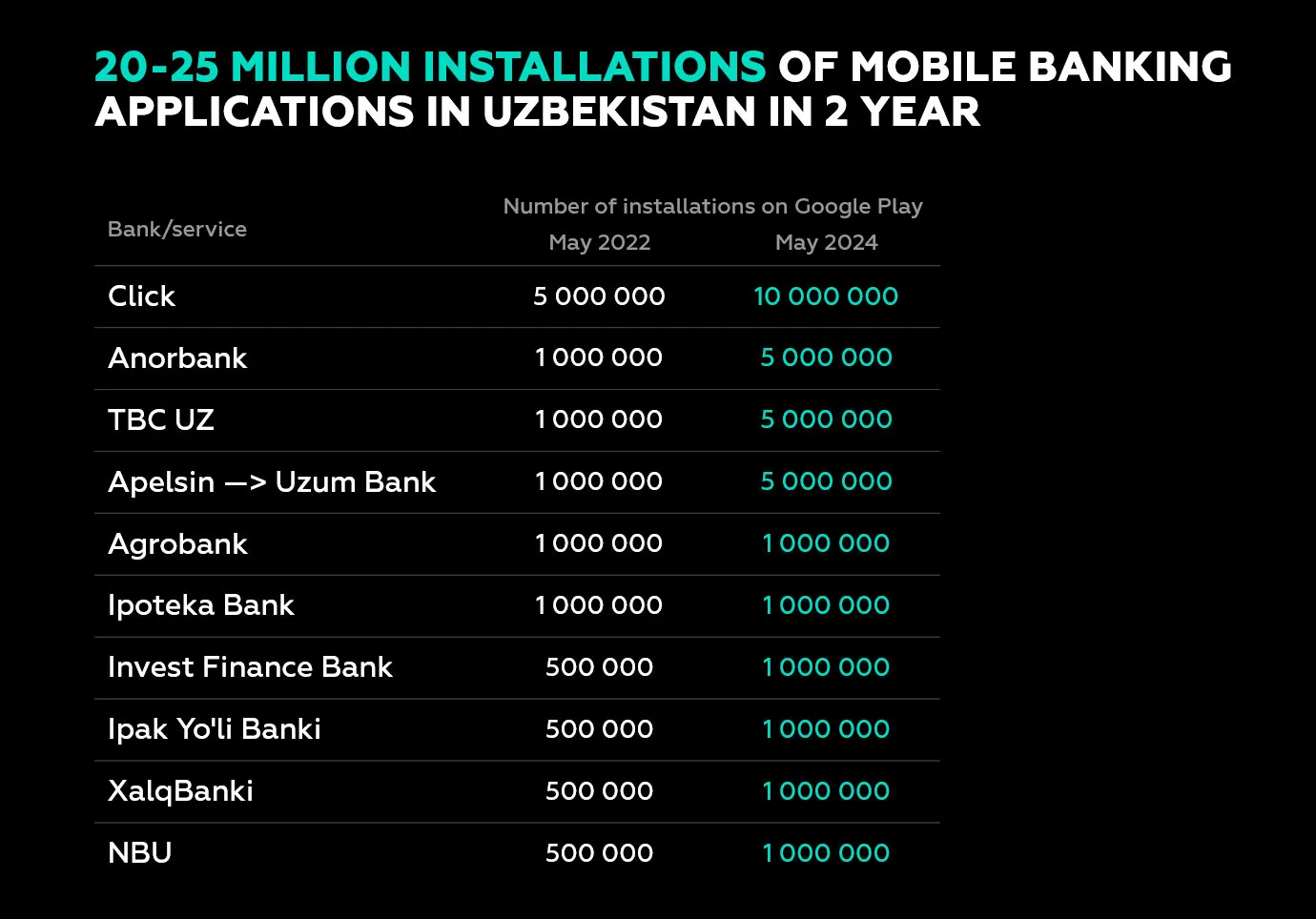

Over the past two years, Uzbekistan has seen 20-25 million installations of mobile banking applications.

While this high rate of installations indicates a growing interest in mobile banking, it also highlights a critical challenge: ensuring that these applications meet user expectations and preferences. The mere increase in installations does not guarantee user satisfaction. It is essential for banks to focus on delivering high-quality mobile banking experiences that are intuitive, reliable, and tailored to the needs of their users.

The quality of customer experience in mobile apps is a №1 factor that can significantly impact business success.

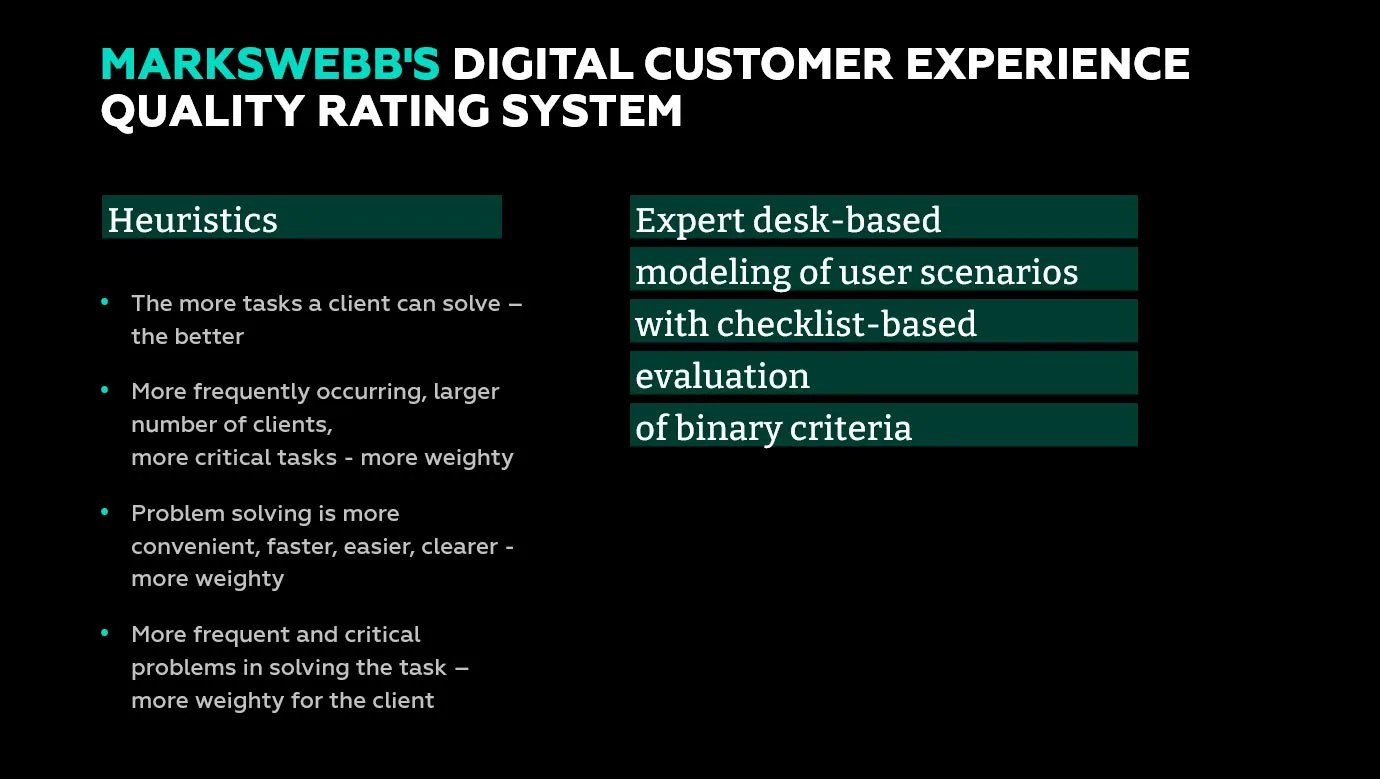

The Markswebb evaluation system offers a comprehensive approach to assessing digital customer experiences. This system emphasizes the importance of resolving frequent and critical issues encountered by users, thereby enhancing the overall usability and satisfaction of the mobile banking applications.

The Markswebb evaluation system provides a structured approach to assessing the quality of digital customer experiences in mobile banking applications. This system focuses on several key aspects:

By applying this evaluation system, banks can gain valuable insights into the strengths and weaknesses of their mobile banking applications.

The Markswebb system also facilitates a comparative analysis and rating of leading banking and payment applications in Uzbekistan. This process involves benchmarking local applications against international best practices to identify areas for improvement. The comparative analysis helps in:

To enhance the quality and functionality of mobile banking services in Uzbekistan, it is crucial to adapt and integrate global best practices. This involves:

By the way, we have a unique database of the best European fintech practices. The Banking Growth Features Navigator and the Best Mobile Banking Apps Database developed by Markswebb represent great tools for businesses aiming to enhance their digital offerings and secure a competitive edge in the market. These resources provide comprehensive insights into successful strategies and innovative solutions implemented by leading mobile banking applications across Europe. If you need us to gather a specific set of solutions tailored to your business needs or require custom data collection for your digital service, the Markswebb Scout team is ready to assist. Additionally, the Global UI Search service allows access to digital services in any country worldwide, enabling you to benchmark and adopt the best practices from global leaders. For further information about how our Navigator and Database can assist your business, or to explore the potential of the Global UI Search service in detail, please do not hesitate to contact us. Our team is ready to provide tailored support and insights that align with your specific needs and objectives.

To maintain and accelerate the growth of mobile banking in Uzbekistan, it is essential to look beyond the local market and adopt successful strategies from leading global markets.

By studying international innovations, Uzbek banks can identify effective solutions that have been proven to work in diverse environments. This adaptation process involves customizing these innovations to fit the unique needs and preferences of the Uzbek market, ensuring that they are relevant and beneficial to local users.

The fintech landscape is dynamic, with new trends and technologies emerging regularly. To stay competitive, Uzbek banks must continuously monitor global developments in the fintech sector. This ongoing learning process allows banks to anticipate future trends, prepare for upcoming challenges, and swiftly adopt new technologies and practices. By keeping a finger on the pulse of the global market, Uzbek banks can remain agile and responsive to changes, ensuring they are always ahead of the curve.

Collaborating with international experts and utilizing advanced technologies from around the world can significantly enhance the quality of mobile banking services in Uzbekistan. By tapping into global expertise, local banks can benefit from the latest insights, methodologies, and technological advancements. This collaboration not only elevates the standards of mobile banking services but also fosters innovation and growth within the sector. Leveraging global expertise ensures that Uzbek banks can offer cutting-edge solutions that meet the highest standards of efficiency, security, and user experience.

The development of mobile banking in Uzbekistan is driven by increased card issuance and a shift towards cashless transactions. To sustain and enhance this growth, adopting a global perspective is essential. By integrating international best practices, monitoring global trends, and leveraging global expertise, Uzbek banks can ensure their services are both competitive and user-centric.

Structured evaluation systems like Markswebb and comparative analyses with global leaders provide critical insights and highlight areas for improvement. Customizing international innovations to local needs will further enhance the quality and functionality of mobile banking.

To stay at the forefront of the fintech industry, Uzbek banks must be agile, innovative, and responsive to global developments. Are you ready to elevate your mobile banking services to a world-class standard? The best time to act is now!

We respond to all messages as soon as possible.

We’ve evolved dozens of successful financial services and are eager to prove that our expertise can be implemented in other industries and around the world. Have a look at our success stories!