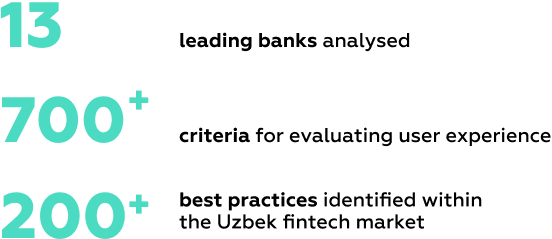

We are excited to announce the upcoming publication of our comprehensive study, Mobile Banking Rank Uzbekistan 2024, slated for release in June 2024. This pivotal report delves into the mobile banking scene in Uzbekistan, spotlighting the services offered to private clients.

This research aims to provide an exhaustive overview of the state of mobile banking, pinpointing prevailing trends and identifying the most effective practices within the sector. It leverages an extensive set of criteria to enhance the accuracy of the user experience evaluation across various banking applications.

The full report is now open for requests. It targets stakeholders seeking a detailed and factual insight into Uzbekistan's mobile banking ecosystem.

Update! The Mobile Banking Rank Uzbekistan 2024 is now available! You can review the contents and obtain the public report (for free).

Contents

The Mobile Banking Rank Uzbekistan 2024 report offers an unparalleled comparative analysis of the digital client experience in Uzbekistan's mobile banking sector, catering to private users. This yearly study furnishes a detailed market overview, bringing to light emerging trends, effective practices, and rankings of mobile banking applications. It aims to foster the development of superior mobile banking services, aligned with the specific demands and nuances of Uzbekistan's financial environment, while drawing on successful strategies from both the CIS region and Europe.

The research provides an impartial view of the competitive dynamics in mobile banking, offering essential insights that aid in strategizing the enhancement of digital banking services. By granting access to over 200 best practices across 17 categories of user tasks, the study endeavors to hasten the innovation and implementation of new mobile banking solutions.

A carefully selected list underpins this research, incorporating only the most impactful and widely utilized banking services. This method ensures a thorough depiction of the sector's yearly evolution, making it easier to spot key trends and successful practices that could benefit the broader banking community.

The end product is a detailed 400-page report, encapsulating crucial findings and insights vital for shaping the future of mobile banking in Uzbekistan.

Are you keen on acquiring comprehensive knowledge of Uzbekistan’s mobile banking and fintech landscape?

Place your request now to secure the complete report.

The forthcoming Mobile Banking Rank Uzbekistan 2024 report is set to unveil a host of insights into the mobile banking sector in Uzbekistan. Planned insights and guiding research questions include:

These findings will prove crucial for banks aiming to amplify their impact in the digital domain, reflecting on annual shifts and the remarkable increase in mobile banking services.

"Fintech is experiencing rapid growth in Uzbekistan, playing a pivotal role in improving financial inclusion, driving digital transformation, and contributing to economic development.”

by Fintechnews

Markswebb's research strategy in the fintech market is encapsulated in a preсise formula that combines:

This formula is designed to deliver comprehensive insights into the mobile banking landscape, facilitating strategic decision-making for financial institutions. Employing this formula, Markswebb generates a concise, empirically grounded overview of the mobile banking industry, equipping financial institutions with critical benchmarks and insights to inform their strategic planning and operational enhancements.

The Mobile Banking Rank Uzbekistan 2024 full report by Markswebb is a comprehensive 300-page PDF document designed to offer an exhaustive analysis of the mobile banking landscape for private clients in Uzbekistan. Here are its key features and benefits for businesses:

With high expectations for the banking market in Uzbekistan, forecasts predict significant growth. This report not only reviews digital payments but also provides insights into the burgeoning Uzbek fintech market, highlighting the crucial role of mobile banking applications in shaping future trends.

By sharing a portion of the findings with the public, our goal is to offer a market analysis beneficial to a broad audience. We plan to spotlight specific practices that could inspire services worldwide, providing a unique perspective on the strategies that fuel success within Uzbekistan's digital banking sector.

Stay tuned for the release of this comprehensive study, poised to revolutionize our understanding of mobile banking and fintech strategies in Uzbekistan. Follow Markswebb on LinkedIn!

We’ve evolved dozens of successful financial services and are eager to prove that our expertise can be implemented in other industries and around the world. Have a look at our success stories!

From research and analysis to strategy and design, we help our clients successfully reach their customers through digital services.